Asia Communique

China’s $200 Billion U.S. Lending Spree Revealed—How Beijing’s Banks Are Quietly Buying Influence in Western Tech and Infrastructure

Dear Readers,

New AidData findings expose scale of Chinese state lending to the U.S. and allied economies

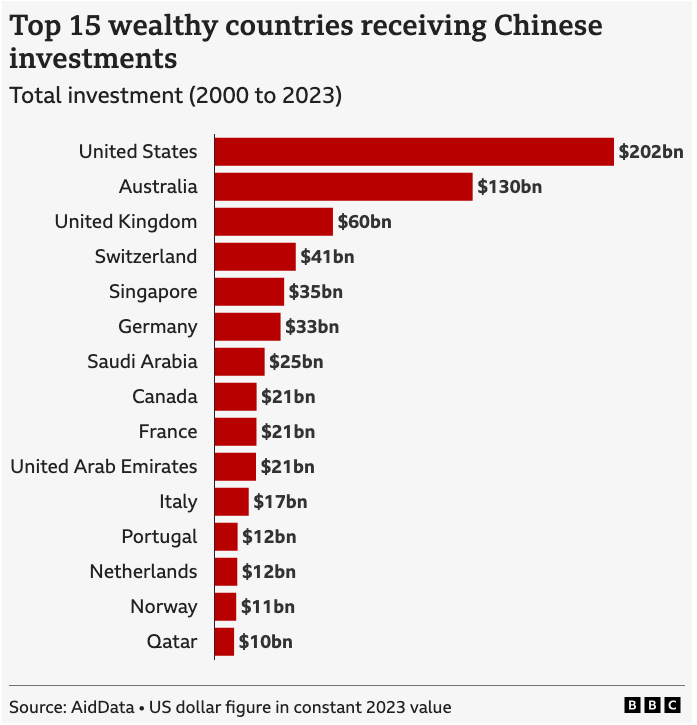

The Washington Post and BBC News released reports on 18 November 2025 based on fresh research from the AidData lab at William & Mary university. The research shows that Chinese state banks have quietly extended hundreds of billions of dollars in loans and investment credit to projects in the United States and other advanced economies. AidData’s dataset covers more than two decades of transactions and highlights how Beijing uses state‑directed finance to gain leverage over strategic assets and technologies.

Chinese finance floods U.S. infrastructure and tech

AidData estimates that Chinese financial institutions have provided more than $200 billion in loans to U.S. infrastructure and tech projects over the past 25 years—more than they lent to any other country. Researchers found that Chinese lenders backed about 2,500 projects in the United States between 2000 and 2023, ranging from gas pipelines to airport terminals across almost every state.

The lending binge accelerated recently: over half ($103 billion) of the Chinese lending occurred since 2018, coinciding with Beijing’s drive to dominate high‑tech sectors.

AidData’s director Brad Parks told the Washington Post that Chinese state‑owned commercial banks frequently participate in syndicated loans and other profit‑driven deals that help Chinese firms buy U.S. and European companies. These banks “are intimately involved in Beijing’s efforts to lead in artificial intelligence, clean‑energy technology and advanced robotics.” Records show Chinese credit lines were extended to household names such as Amazon, Halliburton, Tesla, Boeing, Qualcomm and Disney.